In a recent post, I wrote about the importance of including competitive benchmarks in retailer category assessments. In this post, I’ll build on this concept by showing you how to construct an Opportunity Gap Analysis.

In a recent post, I wrote about the importance of including competitive benchmarks in retailer category assessments. In this post, I’ll build on this concept by showing you how to construct an Opportunity Gap Analysis.

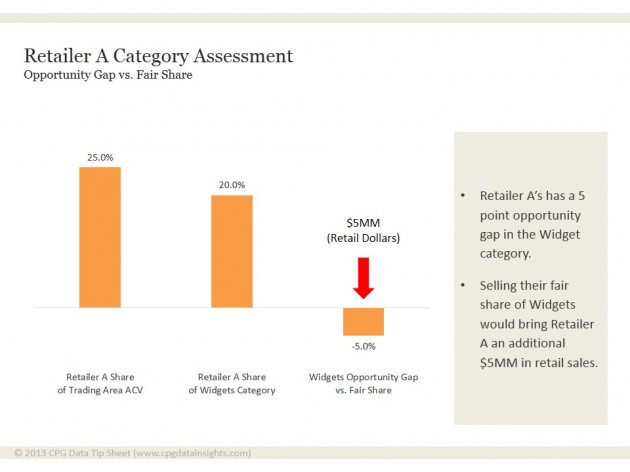

This analysis examines whether the retailer is getting its fair share of category sales, compared to competitors. And, more importantly, it puts a dollar value on closing any gap.

It’s a simple but powerful approach. You compare a retailer’s market share across all categories (their share of trading area ACV) to that retailer’s market share for your particular category.

For example, let’s say Retailer A’s share of trading area ACV is 25%. All things being equal, the retailer should capture 25% of the dollars for any category. This is the retailer’s “fair share”. Of course, retailers won’t sell their fair share of every category – there are areas of strength and weakness for any retailer. But if the retailer isn’t attaining their fair share, then there’s a quantifiable opportunity that’s worth exploring.

To further illustrate, let’s plug in some numbers.

In this example, Retailer A has ACV of $1 billion and Trading Area ACV is $4 billion. Retailer A share of ACV = 25%

Before we dive further into the example, a couple of notes on pulling this data from Nielsen/IRI:

- IRI gives you data for the total trading area which they call the CRMA. However, Nielsen gives you the competitors’ ACV. They call it ROM (Rest of Market). So to get the total trading area ACV from Nielsen, you need to add the retailer ACV and the ROM ACV.

- Nielsen/IRI express ACV in millions of dollars. Given that, the number that appears in the database for Retailer A would be $1000, not $1,000,000,000.

- Retailer ACV is a measure available in some, but not all, Nielsen and IRI databases. And it is not provided when you buy an ad hoc Excel report unless you explicitly request it. If you are missing this measure, do not despair! Here’s a post showing you how to estimate retailer ACV.

To see if the retailer is selling its fair share of your category, you’ll need category dollars for the retailer and the trading area. Let’s say that retailer category dollars are $20 million and trading area category dollars are $100 million. Usually you would use annual numbers for this type of analysis and demonstrate an annual opportunity.

Retailer share of trading area category sales: 20 / 100 = 20%

So here you’ve identified an opportunity gap versus fair share:

25% ACV share – 20% category share = 5 point gap

To make your case even more compelling, you can calculate the value of increasing category sales to reach fair share. The value of one share point in a Trading Area is always category dollar sales divided by 100. Then multiply that by the size of the opportunity gap. So in this example:

Value of one share point: $100 million / 100 = $1 million

Value of closing opportunity gap: $1 million x 5 point gap = $5 million

You’ve just identified a way for Retailer A to gain $5 million in retail sales! This is a great place to start your presentation. I expect management will listen closely when you suggest category adjustments to close that opportunity gap.

Need help getting started with your category assessments? Contact us to discuss how our consulting services can help you with this or any other Nielsen/IRI challenges you’re facing.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles twice a month. We will not share your email address with anyone.

Hi – Did you ever have an updated post on how to calculate Retailer share of ACV? I was using retailer RMA dollar sales divided by retailer’s CRMA dollar sales to get this calculation, but not sure if that is the correct way to go about it.

Hi Sokhom,

We do have a post on estimating retailer ACV. Thank you for pointing out that I never linked it to this related post – I’ve added that link above.

Do you have retailer ACV as a measure in your database? If so, then you don’t need to read my post and you can calculate share just as you described above. Make sure you are dividing retailer ACV by total trading area ACV. In other words, the denominator needs to be retailer ACV + ROM ACV. I believe CRMA does equal retailer + ROM.

However, some databases don’t include a total ACV number. In that case, you will need to follow the approach outlined in the post to back into the numbers using dollars and dollars per million for an item with full distribution.

Hi Sally,

I am trying to gain more knowledge about different metrics in CPG industry, I have understanding of the Metrics you have discussed on the website. I would be very grateful if you could direct me towards a book or further resource material to build up my understanding further.

Thanks in advance!

Ashish

Hi Ashish,

Here are a few resources (please let us know if you locate others):

http://www.cmkg.org is a category management training company that has some great online resources and they may have some downloads that relate to metrics.

The TABS group (www.tabsgroup.com) is a consulting company that has some interesting webinars that are free to access. TABS CEO, Kurt Jetta, always looks at data in interesting ways. He posts on LinkedIn as well so is a good person to follow there.

A good reference for marketing in general is “Marketing Metrics: 50+ Metrics Every Executive Should Master” by Farris, Bendle, Pfeifer and Reibstein (Wharton School Publishing).

Can you recommend any good resouces to keep updated on Grocery retail trends and Category management ?

Thanks

Three relevant LinkedIn Groups:

News sources:

IRI and Nielsen are always publishing interesting press releases and white papers. And the Grocery Manufacturers Association (GMA) has some great white papers going way back. I recently read one from 2009 that was still very relevant and helpful – the grocery industry doesn’t change that quickly.

Lastly, big consulting companies with CPG practices (like BCG and Deloitte) have great articles and studies. Go to their general websites and then find the page for their CPG practice – you’ll be sure to see some good resources.

Hi Sally,

thanks for this article. Is there any other article where we can do opportunity gap analysis with respect to price from the manufacturer perspective?

Thanks,

Prakash

Prakash,

You may find Robin’s article on price gaps or other articles in her pricing series to be helpful. Quantifying opportunities with regard to price is challenging with standard, aggregated syndicated data, however. Without a measure of price elasticity (typical obtained through modelling and highly variable from one product to the next) it is hard to feel confident that one has an accurate estimate of the volume impact associated with any change in price.

Best,

Sally

Hi Sally,

Are we able to use this calculation to find Fair Share Gap opportunities at the brand level?

Thanks,

Randall

Do you mean calculate whether a retailer is selling its fair share of a brand rather than its fair share of a category? Yes you could theoretically do that. I’m not sure it’s useful though because any brand over or underdevelopment are going to be a combination of category development and brand share. So probably better to look at those separately.

Hi Sally,

I have IRI data and am trying to calculate distribution fair share and opportunities at the brand level within a retailer or channel. For example, “Brand A has X% share of distribution but Y% share of Channel dollars, so raising Brand A share of distribution by Y%-X% would be a $Z opportunity”

Any thoughts on this type of analysis from the perspective of a brand within a retailer? I’ve tried to use TPDs and some of the numbers come out a little questionable, wondering if you have guidance on this.

Hi Phill,

My co-blogger Robin has written a post on that very topic!

Are You Getting Your Fair Share of Distribution?

I hope this will address your questions and feel free to write again if you have additional questions.

Best,

Sally