It’s a pleasure to feature this guest post from our colleague and fellow consultant Dan Wasser. Dan’s data expertise and savvy insights derive from long experience with syndicated data and category management in a variety of roles. You can learn more about Dan (and how to contact him) at the end of this article.

It’s a pleasure to feature this guest post from our colleague and fellow consultant Dan Wasser. Dan’s data expertise and savvy insights derive from long experience with syndicated data and category management in a variety of roles. You can learn more about Dan (and how to contact him) at the end of this article.

Robin Simon’s recent article on how best to understand the impact of getting varying percentages of your shoppers to buy just one more unit was outstanding and one that allows you to play ‘what if’ games with the data. But I want to take this a step further. As you know, not all shoppers are created equal nor do they contribute to your category performance as a like group. Some households will purchase your category once every other week while others will only make a purchase a few times a year. And then there are those who will put three or four units into their basket on each occasion while others will only toss in one.

Wouldn’t it be great if there were a way to segment these shoppers based on their purchasing behavior and get a better understanding of how they buy your category and who they are demographically? Let’s save the demo analysis for another article and focus on the segmenting of these shoppers.

Note that I’m using shoppers synonymously with households given IRI and Nielsen report at the household level; we all know that consumers can be those who are the shoppers or simply the ones that consume the goods (think ‘baby food’) so I will avoid using that term.

Let’s Start with an Example using Actual Data from a Number of Years Ago

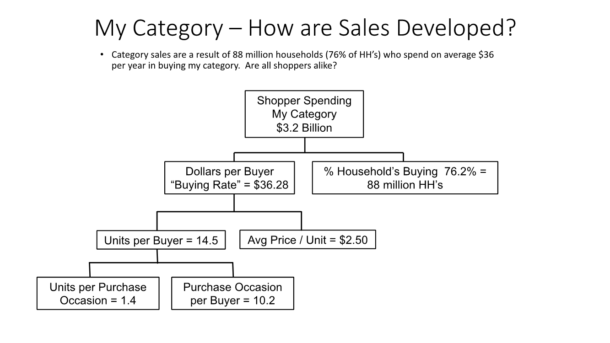

We can see in the data the category is highly penetrated with the aggregated shopper purchasing it almost once a month and putting either one or two units into his/her basket. Multiplying the purchase occasions by the units per occasion gives you an annual buying rate of 14.5 units.

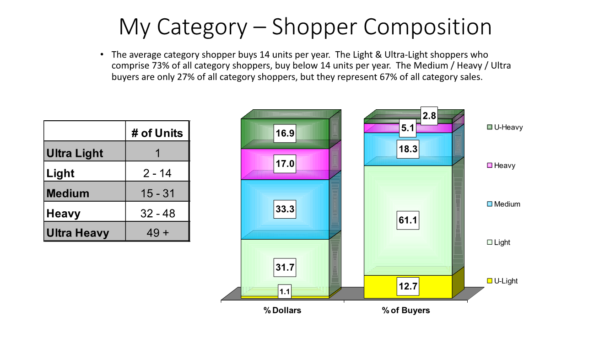

But are all shoppers alike? Does anyone behave like this “average” shopper? To find out, we asked IRI to segment these shoppers into three initial groups and then expanded to five with the result showing one-third of the dollars coming from each of the Light, Medium and Heavy buyers. Once we had these three groups, we further segmented them by isolating one-time shoppers as well as those deemed Ultra Heavy. We ran purchase summary data on each to understand their purchasing dynamics.

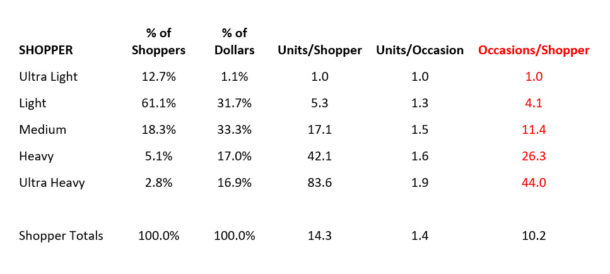

You’ll notice that I’ve highlighted in red the Occasions/Shopper column because this metric is the key differentiator in what drives a shopper to move from Ultra Light to Ultra Heavy. Most shoppers put 1-2 units into their basket on each occasion so that’s not an area you would focus on if you wanted to grow sales. We saw in the previous chart that the category penetration is quite high at 76% so there’s not much more room to grow here either. So, let’s examine the occasions in greater detail. Some shoppers buy the category nearly once a week while others add it to their list on a very infrequent basis. On the flip side, it surprised us to see that nearly 13% of our annual shopper base consisted of one-time shoppers. And this was at the category level!

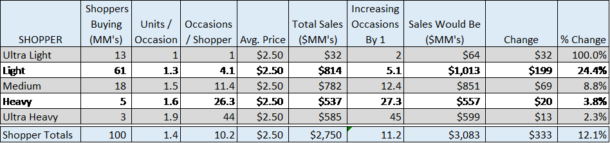

So, what did we do with these insights? We focused our efforts on increasing our shoppers’ purchase occasions. If we could get our shoppers to increase their occasions by just one, it would translate into real dollar growth of over 12%! You do the math:

This format also allows us to vary our assumptions by group or focus in on groups which might be easier to impact (e.g., Light and Medium). NOW you can have your syndicated data provider run demographics on these groups to see what else you can learn about them. By knowing their income levels, marital status, presence of children, education, etc. you can formulate targeted messages or meal deal programs or any other consumer and trade programs you and your retail partner care to engage these key shoppers in. Look for a future post covering the topic of demographics!

Dan Wasser has over 35 years in Category Management and Shopper Insights. He is the Founder and Managing Director of DJW Insights where he has consulted for a number of small to mid-sized CPG organizations. His prior experience includes leadership positions at Fresh Express, Chiquita and IRI. He can be reached at dj3w@comcast.net or on LinkedIn.

Should you have any questions on this article, please direct them to Dan or leave your question below and we’ll ask Dan for an answer.

Great article! The thing I always struggled with when looking at segmentation is how to target the under performing segments. I guess you would need more information on their demographics.

Hi Jennifer, thanks for your comment. Yes, demographics on each of the segment groups is a great start but another idea would be to have IRI/Nielsen take each of these groups and run a purchase trend report by four-week period with some basic measures to see when they’re shopping the category (seasonal? holidays? during high promotional periods) thus allowing you to see what’s tripping their purchase trigger. You can also see what items they’re buying so if they’re coming in on your low priced items, maybe consider on-pack coupons during their key buying time to induce them to trade up to a higher priced SKU.

This question is not directly related to the topic of segmenting shoppers but more understanding what is the best way to segment customers (retailers) and what approach would you recommend to drive that

I don’t have a solid answer because this is not something I’ve done so I’m extrapolating from general marketing knowledge here!

As always, you’d likely want to start by making sure you know your objectives for the segmentation. Why are you segementing them in the first place? Your scheme might be different depending on your objective. Do you actually want segments or more of a prioritization? Given that, what’s the best basis for the groupings. It could be geography or shopper demographics or pricing strategy or their historical support for your brand or category development.

As with any segmentation, you also need to think about whether you can treat the groups differently. If you can’t execute differently across the segments, there’s not much point in segmenting.

Hope this helps!