How you present your analysis is at least as important as the numbers themselves.

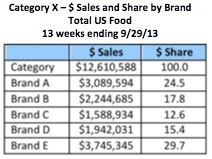

One of the most basic measures to gauge how well your business is doing is share, what portion of category sales your brand accounts for. Of course, higher is better and the sum of shares for all brands in the category has to equal 100. Take a look at the following table:

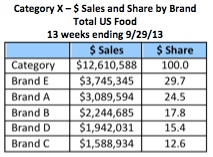

If the brands are listed in alphabetical order, it is not always easy to immediately see who is the biggest and smallest and where the other brands fall in between. One way to improve the table is to sort the brands in descending order. Now you can quickly see the order but, aside from the fact that Brands E and A have higher share than the other brands, the relative sizes are not obvious.

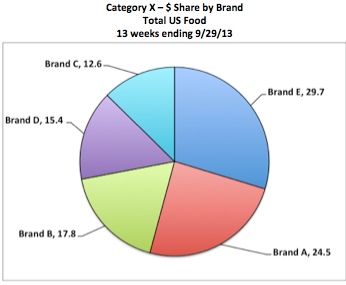

Usually the best way to show share is in a pie chart:

Now it is easier to see the relative size of all the brands and how they compare to each other. The pie also lets you know that all the brands in the graph make up 100% of the category. (If you use a bar or column chart instead of a pie, the reader has to add up all the shares in the chart to see if the sum of the shares shown is 100, that all brands are being shown.)

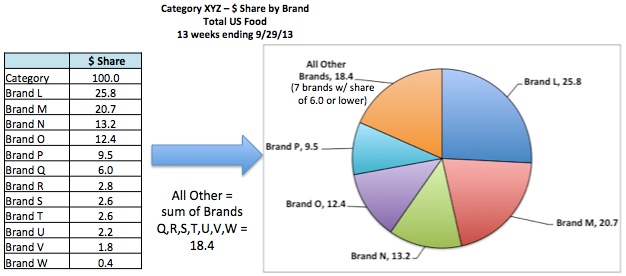

Too Many Brands?

If there are LOTS of brands in the category, as in way too many to look nice in a pie chart, then you can show the top, say, 5 or 6 brands and create an aggregate for “All Other Brands.” It’s a good idea to indicate how many brands are making up the All Other.

If your brand is one of the small ones that falls into All Other Brands, then you can still show a slice of the pie for your brand and just add up all the remaining brands, which can still be called All Other Brands.

Keep in mind that you can also use a pie chart to show other kinds of share, like share of distribution or share of merchandising. Whenever everything you’re showing adds up to 100%, a pie chart is the way to go.

Have other questions about what’s the best graph to use? Look for future posts on comparing prices, trending over time and other topics related to showing your data in a visually compelling way. Feel free to leave a Comment for this post.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles once a month. We will not share your email address with anyone.

Great article, one of those fundamental metrics that get overlooked. I think market share should be a “5th P” of marketing, called “Power!”

Kudos to you Robin! Great article.

One add… pie charts are great for snap shots, but to gain understanding of changes over time, line graphs give you a better view of longitudinal data.

For those who want to understand their market share at Amazon.com, visit us at http://www.oneclickretail.com.

Thanks, Mark and Spencer!

You are right that a line graph is used to show trends over time – I will be doing a future post on that. I will also cover other types of graphs in the future.