If Average Items Carried (or Average Items Selling) is not available on your database, it is easy to calculate in Excel. It is just the sum of % ACV Distribution of all the items divided by the % ACV Distribution of the brand.

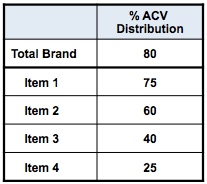

Here is an example:

Say a brand is made up of 4 items, with % ACV Distribution as shown in the table above.

Avg Items Carried = (75 + 60 + 40 + 25) / 80 = 200/80 = 2.5

This means that, on average, retailers that carry the brand sell 2.5 of the 4 items that the brand offers.

Why divide by 80% ACV and not simply add the percentages? (i.e., .75 + .60 + .40 + .25 = 2.0 items) I know the result is different, but I’m not sure why the 80% ACV is relevant. Thanks!

Thanks for the question! If you add up the ACV of each item and then divide by the brand ACV, this tells you the average items in stores that carry the brand at all. In this example, your method gives a lower number (2.0 vs. 2.5) because it is incorporating the 20% of the ACV that has 0 items. I hope that helps.

The other way at looking at this would be Brand TPD/Brand %ACV. Do you have a view which is better to use, MAX %ACV or Avg Weekly %ACV?

You are right, Aaron – I will be covering Total Points of Distribution in a future post. Brand TPD = the sum of % ACV of all items within the brand.

Regarding Max vs. Avg Weekly %ACV…You should try to use the same one (Max or Avg Wkly) in the denominator of the Average Items calculation that is used in the TPD measure. If distribution is pretty stable, then either one will give you a similar result. For slow-moving items r items with increasing distribution, you probably want to use Max, which will be greater than Average Weekly, in the denominator. This will result in a lower (but more accurate view of) Average Items.

Hi,

Is there another post, or can you explain, how to calculate the brand ACV? (I tried searching but could not find a post relating to this)

I can do a total by function which provides ACV at brand level, though the ACV figures at brand level seem extremely low so I am wondering what to use in order to get the 80% ACV?

Hi Tamara,

With Excel reports and the older IRI/Nielsen systems (Nitro and XCelerate) there is no way to calculate %ACV for a brand from it’s component UPC’s. In most cases, a brand level distribution number will be provided by Nielsen/IRI. If you aren’t provided a brand level distribution number or the “brand” definition isn’t correct, the best you can do is look at the individual items and know that the brand %ACV will be at least as high (and probably higher) than the highest individual item.

In the newer Nielsen/IRI systems (Nielsen Answers, IRI Liquid Data or IRI Advantage), you should be able to group items into a “brand” and calculated a brand-level number that is accurate.

Best,

Sally

I just saw an IRI report that listed a brands max ACV at 450%. How does a brand have an ACV greater that 100?

You are correct – a brand cannot have an ACV distribution of greater than 100 in real life! This can happen, though, when you pull the ACV distribution for an aggregate of products that are not in the built-in hierarchy on the database AND you are using IRI’s xLerate or Nielsen’s NITRO. Those tools will simply sum the ACV across items and can easily exceed 100. The newer tools (IRI’s Liquid Data or Market Advantage and Nielsen’s Answers) should give correct ACV number even when aggregating items on the fly.

I wonder if the measure you are seeing is really Total Distribution Points (TDPs) and not ACV. In that case, it would usually be greater than 100. (Note that TDPs are called “TPDs” or Total Points of Distribution in IRI.)

Hope this helps!

Hi Robin,

I saw a UPC weighted distribution showing 326 in Nielsen nitro, How it can go more than 100. Can u explain plz

Ratheesh,

Some distribution measures like %ACV Weighted Distribution and % of Stores Selling are bounded by 100. But there is also the Total Distribution Points (TDP) metric where the distribution for each UPC is summed up to the brand or product group or category level. If you distribution metric is over 100%, and it’s being correctly calcualted, it must be a TDP type metric. See here for more on TDP:

https://www.cpgdatainsights.com/distribution/total-distribution-points-post/

Hi there,

Why does the brand’s ACV not equal the sum of ACV for all the SKUs?

Thanks!~

Hi Lisa,

There are two ways to look at distribution for a brand.

The first is to look at the % ACV measure at the brand level. That is the measure I believe you are referring to in your question. % ACV for a brand looks at whether any SKUs for that brand are present. So summing up distribution across all skus would double count brand distribution. If any sku is in distribution, then it’s a check mark for brand distribution and there’s no need to go further.

A second way to look at distribution for the brand is total points of distribution (TDP or TPD). That measure sums up % of ACV for all SKUs, just as you are suggesting. For that measure, it doesn’t just matter whether the brand is there at all but instead takes into account the number of SKUs in distribution for that brand.

Hi, Sally

You answer about the brand and sku ACV is very helpful. May I ask a further question? If I have sku level %ACV for several brands, all in the same category, which measure/metric should I use to compare brand level distribution? Does it make sense to use TDP/TPD?

As Robin mentioned TDP in an earlier response, TDP can be great than 100. So can I compare distribution of several competitor brands by simply summing up their sku level %ACV to get to TDP? Thank you so much.

Yes! If you add up the %ACV for all items within a brand, that is the brand’s TDPs. That is really the best way to compare distribution between brands, especially when the brands have very different sized portfolios in terms of number of items.

Thanks a lot for your useful descriptions. When calculating Average Items Carried, is it correct to include products that have a very low % ACV Distribution (there are many items that have a distribution of less than 5% as they have been delisted a few years ago but some stock is still on shelves)? Don’t they alter the final result?

Furthermore, how do you interpret the results? Should you always compare results with the actual number of items in a brand’s portfolio (i.e. avg items carried = 2,5 and actual items in portfolio = 10 means that the brand has low distribution or weak variants?)

Yes! You should include all products when calculating average items, regardless of their %ACV. Even if an item has been discontinued by the manufacturer and/or delisted by the retailer, if it still selling at shelf then it should be included. If the distribution is really that low then it will not affect the average items that much, especially when you are talking about average items in the range of 120.

You should always compare average items to the number of items available. In the example you give, that means that retailers are not selling anywhere near all the items offered so you could say they have low distribution because many of the items are probably not that fast-moving.

Hi again! I need an explanation on AVG items carried. When calculating AVG items carried for a total market, I get a specific result. When I calculate it per retailer, I receive in some cases a larger number (e.g. Total Market 110, retailer A 130). How is this possible? If a retailer sells on average 130 items, the figure for the total market cannot be below this number.

Your calculations are correct! It is possible (and almost always happens) that some retailers have more items and others have less than the Total US. You can think of the Total US number as a national average, not as a maximum. For example…in one market for a particular category, Retailer A can have 130 items while Retailer B has only 90 items. If both retailers each have 50% of the ACV in the market (they are the same size and they are the only retailers in the market), then the average items for the market would be 110. Hope that helps!

Calculating average items carried doesn’t seem to work when distribution is low. For example: (15+10+5+10+8)/19=2.5 It doesn’t make sense to me that retailers would on average carry 2.5 of the 5 items available, when overall ACV is so low. What am I missing?

The calculation does work fine, regardless of the level of ACV distribution. In your example, the brand is 19% of the ACV and in that 19%, retailers carry between 2 and 3 (of the 5) items. Most of the retailers that carry the brand have the first item (15/19), about half of them have the items with 8-10% ACV and then about one-fourth (5/9) have the item in lowest distribution. So it does make sense that, on average a retailer that carries the brand at all has between 2 and 3 of the items.

Hope that helps! (If you want to discuss further, please use the Contact Us form and I’d be happy to chat.)

Does AIC represent average items carried per store in a given geography or across the market/geography? In other words, if the geography includes only 59 stores, is the AIC figure at the store level or total market level?

Thank you!

AIC is interpreted as per store within the geography.

Hi there – this is incredibly helpful!

Just have a question on the aggregation mechanism for this metric – is it appropriate to calculate average # of items at the manufacturer level, across brands?

My understanding is that I could just add the item level ACVs, regardless of brand, and then divide by the total manufacturer ACV?

Yes, that is the correct way to do it. Sum the ACVs of all the items and divide by the manufacturer’s ACV.

Hello — incredibly helpful. I think I may be overthinking. We have a distribution goal for a new product, of 142 TDP. The product has 5 flavors. Right now — 9 stores have total of 38 sku’s. AVG would be 4.2 sku’s ACV. But then how do I calculate TDP from this information. Thanks!

In order to get to TDPs you need to have the %ACV distribution numbers for each item, then just add them up to get brand TDPs at the national level which is probably what the goal is for. How much of the national ACV do those 9 stores account for? I think that’s what you still need to get to TDPs. The calculation you did is average items per store, which is probably close to an average items measure you’d pull from Nielsen/IRI but is not related to ACV. Do you have access to Nielsen/IRI data? Feel free to follow up further by clicking on the Contact Us link.

Framing this up a different way, I was wondering if similar logic could be used to determine a total category’s Average items per store.

In the above example, we have a brand’s %ACV and the %ACV of its constituent items. We add the items and divide by the brand and get 2.5.

What if we made one big brand called “All brands” to represent the entire category? So let’s say it’s a very popular category and the %ACV is 100. But it’s very, very fragmented with brands, so let’s say you have 20 brands each with %ACV of 20%.

Would you therefore go:

20+20+20+…+20 / 100

400/100

Average number of items per store within the category is 4?

Yes, the same logic is used for average number of items in the category (or segments). But that is much easier because the denominator is always 100, since the every store has a t least one item in any given category. The math is simple: avg items = sum of %ACV of all items / 100.