What Channels Are Available From NielsenIQ and Circana?

What Channels Are Available From NielsenIQ and Circana?

This is one of our most frequently asked questions! It sounds like a simple one but, as with most things involving syndicated data, the answer is not so simple.

In this post, I’ll provide an overview of which types of retailers are available from the FMCG syndicated data vendors. In part 2 of this series, I go into the nitty gritty details for the most commonly purchased markets, including what geographic detail is available and which retailers do and don’t cooperate.

Important note! This post is for the U.S. only. Check with the data vendors directly for more information on what is available in other countries.

NIQ/Circana/SPINS POS-Based Brick and Mortar FMCG Markets

Syndicated POS (aka scanner) information from brick & mortar stores is the data most frequently purchased from NielsenIQ (aka NIQ) and Circana. This data covers at least part of brick & mortar sales for 12 different channels. This data is available to any manufacturer on both a subscription and ad hoc basis, it’s easy to work with and robust, and relatively affordable.

The following 6 channels would be of interest to most FMCG manufacturers. NIQ and Circana 1) provide very similar information for these channels, 2) offer account level detail for most key retailers and 3) include them in their multi-channel markets (we have a whole post about those multi-channel markets which are called MULO and xAOC).

- Grocery/Food

- Mass Merchandise/Walmart

- Drug

- Dollar

- Club

- Military

There are three more channels covered by NIQ/Circana which are relevant to many but not all FMCG manufacturers.

- Convenience

- Pet

- Liquor

SPINS store data covers two more grocery channels plus another channel they call “Alternative”:

- Specialty/Gourmet Grocery

- Natural/Organic Supermarkets

- Alternative includes non-grocery retailers covered by SPINS (e.g. Vitamin Shoppe).

You can also obtain data from SPINS on conventional markets. SPINS draws their conventional data from Circana (so retailers and coverage are comparable to Circana) but organizes the products differently than Circana does.

In a future post, I’ll provide much more detail about exactly what’s available for these 12 channels.

Does NIQ/Circana/SPINS Cover the Online Sales for Brick & Mortar Retailers?

This is a very murky situation since e-commerce comes in so many different flavors. In most cases, online sales that are fulfilled in-store will be included in the regular “brick and mortar” data for a retailer. Sometimes the e-commerce information won’t be reported by the retailer at all. Some retailers have e-comm markets available from NIQ or Circana. Others don’t. It depends on the retailer and how their e-commerce data is captured within their system and how their online sales are fulfilled.

Please contact NIQ/Circana directly to obtain details about exactly what’s offered for your category and at what price. These services are evolving quickly and the vendors themselves are the best source for specifics.

What About Amazon And Other Pure Play Online Retailers?

E-commerce data offerings are more dynamic than traditional brick-and-mortar data offerings so please do your own research and don’t rely just on this post which may not be up to date! Always ask Circana and NIQ about their offerings in this area. They will be working to improve them and buying or partnering with other data providers. Also check and see what the latest offerings are from other vendors.

Historically, there has been great information on e-commerce in general, and Amazon specifically, coming from Profitero. Another source is Flywheel Digital. In addition to sales estimates for Amazon and other e-retailers, they provide what I would call e-commerce causal data (online prices, rank in product lists, etc). Check out this guest post from Profitero’s Keith Anderson for more on those metrics.

Numerator estimates e-commerce sales via their extremely large panel. Their methodology estimates sales using e-receipts and other techniques. IRI partners with Edge by Ascential to provide an online sales offering that is integrated with in-store sales. NIQ offers Amazon markets which incorporate Fresh, Prime Now and GO.

Another way to assess your business outside the traditional brick and mortar channels covered by Circana/NIQ is through survey data. TABS Analytics (now part of Telus), for example, has historically offered a syndicated services that covered a number of categories.

Can I Get Data For Home Improvement Stores or Office Supply Stores or [insert name of your channel here]?

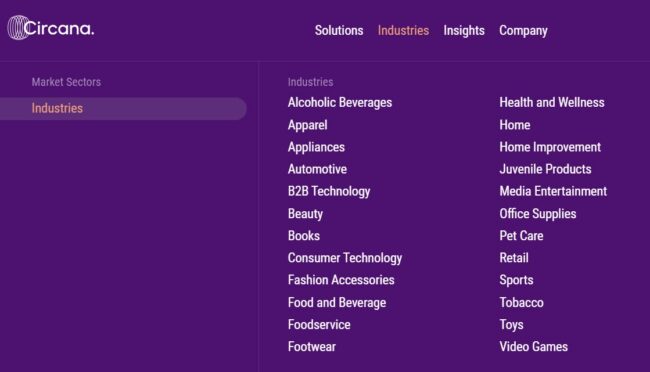

In the past, when someone asked me about data for a channel not traditionally covered by NIQ/Circana, I used to tell them to check with The NPD Group. Then NPD and Circana merged to form Circana. Here is the list of industries now covered by Circana:

Two more options (we have not worked with either of these vendors):

For Hardware/Home Improvement, Epicor’s Vista Information Services constructs their offerings from both POS and panel data from a broad sample of stores. They also cover Electrical Distribution.

Open Brand is a possible data source for Consumer Durables, Consumer Electronics, and more.

If you work in a category like Office Supplies or Home & Garden, you may be saying “I know Circana/NIQ don’t have data from all the retailers I care about. But Target and Walmart and even Kroger sell my products! Can’t NIQ/Circana provide me sales data for those retailers?”. You can (and should) check with them. But NIQ/Circana code only a small subset of the general merchandise products sold by the retailers they work with. If a category is not available that means nobody else is getting that data from them either.

NIQ/Circana also offer information from their consumer panel for Automotive, Home Improvement, and many, many more outlets. However, the set of products that panelists are asked to scan/code may be limited so you may not get a complete picture of the channel and categories from this source. If a category is not available in panel data it’s because the data vendors do not have a big enough client interested in that category. In addition, the panel is not that large so sample sizes are often an issue. The panel is designed to be demographically representative but that doesn’t mean it’s going to translate into representative sales estimates when you are talking about specific products sold in specific outlets. That being said, panel data from NIQ/Circana can be a great solution for certain cross channel business questions and is always worth investigating (provided you have a generous budget).

Nobody Covers My Category But I Need Data! What Should I Do?

If you can’t find any syndicated data, what can you do? Two ideas:

1) Add up all the retailer POS data that you can get directly from your customers. This may not help you assess your share but you will at least have a better picture of consumption (versus shipment) patterns. I wrote this post sharing my tips for combining multiple sources of consumption data.

2) Consider fielding a survey to get an overall picture of your category. Online surveys can be constructed relatively inexpensively and can tell you a lot about brand preferences and category trends.

Help us enhance this post by sharing your experience with the data sources we’ve covered here and/or correcting any errors! We would love to add precision to this post by incorporating our readers’ expertise. Comment below or contact us.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles once a month (or even less frequently). We will not share your email address with anyone.

Great summary – thanks! A couple things I didn’t see mentioned here that might be useful to your readers:

1) Whole Foods data is now available from Nielsen

2) Costco data is available from IRI (for categories in which you sell products at Costco, and with some other restrictions)

Thanks Adam! I am working on a follow up post to cover more details such as the ones you have provided so look for that down the road. Sally

Sounds great – thanks, Sally.

Another great post, Sally. You and Robin are easily maintaining the best online resource about syndicated data. Keep up the great work!

Thanks so much for your kind words! It’s good to know that people are finding the CPG data Tip Sheet useful.

Hi Sally – this is my first time reading one of your posts, and as someone who works in CPG data sales I’m SO happy I stumbled on it. I had to leave a comment because of your mention of sales data outsides of CPG (home improvement, consumer electronics, auto aftermarket, etc). Kantar tracks SKU-level purchases at the register in these categories and more, tied to over 80 million households in the U.S. for targeting, measurement, and other analytics use-cases. It’s amazing how little known this data source is in the market!

Meredith, Thank you so much for sharing this info! Great to know of another resources we can refer readers to. Sally

Very informative post about CPG syndicate data market. You have done a great job. Thanks for the sharing such a great post.

Thankfully. John Plix

This is an incredibly insightful article, thank you. One thing to note is Home Improvement (Home Depot, Lowes, Menards, Wayfair etc) Amazon and Office Supply are covered by Pricing Excellence Market Insight product. Not very well known yet but has very detailed data. pricingexcellence.com

Hi Sally,

Thanks for mentioning NPD in your article. NPD tracks many of the non-CPG industries in the US, Canada, Mexico, and indeed many countries around the world:

* Home Improvement

* Appliances (Small and Major)

* Consumer Electronics & IT

* Video Games

* Toys

* Media & Entertainment

* Sporting Goods

* Footwear

* Apparel

* Prestige Beauty

* Automotive

* Housewares

* Office Supplies

* Food Service