Are you confused by the terms “xAOC” or “MULO?” Do you wonder what happened to FDMx? (Do you even know what FDMx is?) This post will clear things up for you! These are the terms that IRI and Nielsen use for their multi-channel markets. These markets are designed to provide an estimate of sales across various retail outlets.

Before I reveal the secret meaning of MULO, here is some history. Back in the dark ages (like 3 years ago in the world of syndicated POS data!), the largest national market available was an aggregate of Grocery, Drug and Mass Merchandiser stores excluding Walmart. Manufacturers had to rely on other sources to get an idea of consumer sales, trends and share in channels like Walmart, Club Stores and Dollar Stores. In 2012, Walmart decided to share their POS data and once again participate in the world of syndicated data (like they had back in the mid-1990s). As a result of that, plus an improvement in the quality of scanner data from other channels, both IRI and Nielsen expanded their POS scanner data offerings.

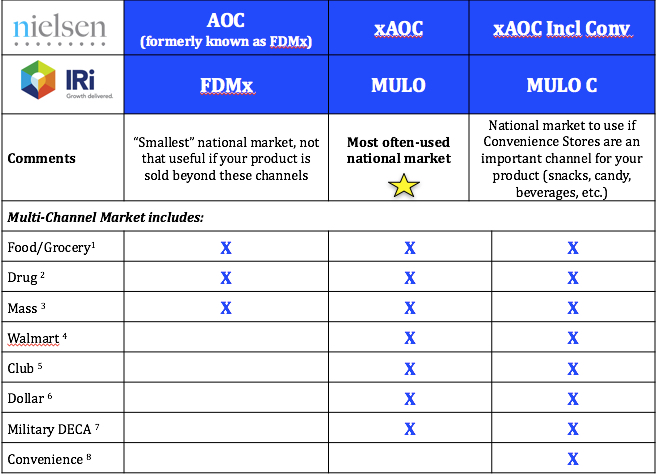

Today the most commonly used national, cross-outlet markets are called xAOC (Nielsen) and MULO (IRI). The Nielsen term xAOC stands for eXtended All Outlet Combined and the IRI term MULO stands for MULti Outlet (and is typically pronounced “moo-loh”). You may also come across MULO C, which is IRI’s Multi Outlet plus Convenience Stores. FDMx stands for Food, Drug, Mass excluding Walmart and is a term still in use at IRI. At Nielsen, they now use the term AOC for what used to be FDMx. (Is your head spinning yet?)

The following chart shows you which channels are included in the various multi-outlet markets available from both of the syndicated data vendors. Below that, see some notes on what is included in each channel.

- Includes stores with at least $2MM annual ACV. Does NOT include Whole Foods, Trade Joe’s or Aldi.

- Includes stores with at least $1MM ACV

- Does not include Walmart

- Includes Division 1, Supercenters and Neighborhood Markets

- Includes BJ’s and Sam’s but not Costco

- Includes Dollar General, Family Dollar and Fred’s Dollar, but not Dollar Tree

- Includes about 120 commissaries

- Includes sample of about 12,500 stores (out of about 140,000 total c-stores)

Still confused? You’re probably not alone. Here are some footnotes from actual company presentations to Wall Street found on the Internet. I’m sure there are many people who do not know what these mean, but now you do!

- Source: IRI FDMx Post-MULO as of 18-Nov-2012

- Source: Nielsen/ IRI, xAOC+C 52-Weeks 12/31/11

When should you use MULO and xAOC? These mega-channel numbers are good for tracking dollar trends or sizing markets overall. But they are not that useful for much else. When you are looking at assortment, pricing and promotion evaluation, it is best to look at channel-specific data. You can look at Food, Drug, Walmart, Military and Convenience Stores separately if you choose to have them in your database. There are no channel totals for Club, Dollar or Mass.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles twice a month. We will not share your email address with anyone.

This is a terrific post that I just came across, really nails the topic.

Thanks for your expertise,

David Orgel

Executive Director, Content

Supermarket News

Thanks! I’m glad you found it helpful. This is our most popular post by far!

Does FDMx still include Wal-Mart. In other words, does the Food/Drug channel include Wal-Mart?

This seems very picky, but…FDMx does NOT include Walmart but xAOC does include Walmart. The x in FDMx means “excluding,” as in “Food-Drug-Mass excluding Walmart.” The x in xAOC means “extended,” as in “extended all outlet coverage.”

What is ‘Remaining US Convenience’ market in Nielsen data?

Is it the subtraction of ‘Total US xAOC Incl Convinience’ and ‘Total US xAoc’?

Many thanks for the reply, in advance.

It’s hard to know what any market is whose description starts with “Remaining…” without seeing the whole list of markets available. My guess is that the database has some specific Convenience retailers that you can pull (like maybe 7-11 and a few others) and then Remaining US Convenience is Total US Convenience channel excluding the ones that you can pull individually. Hope that helps!

thank you for sharing Robin. Very useful.

Do you have any estimates of total store count in Nielsen xAOC and also US Food? Thanks!

I’m not sure if you mean how many stores Nielsen gets data from or how many stores they are projecting to. I think there are something like 30,000 actual Grocery stores in the US (Total US Food) but that includes smaller mom-and-pop stores that are not represented in Nielsen. The xAOC universe is over 100,000+ total stores since it includes mass merchandisers (Walmart, Target, etc.), dollar stores and drug stores. Check with the National Retail Federation – they probably have good and current numbers like this.

Hi everybody,

I have confused about three different data level, and I hope someone help me to figure out the difference between these three levels.

Type 1. Total US xAOC Incl Conv

Type 2. Retailer Marketing Area (RMA)

Type 3. Corporation Reported (CORP)

Also, is it true to say that Base Sales form type 1 is equal to base sale from type 2 plus base sale from type three?

There are really two pieces to a market definition. There is the physical geography bounding the market. And there is the type of store you are interested in – the channel or combination of channels. I think you might be confused partly because you aren’t mentally separating those two pieces.

Total US xAOC Incl Conv: Physical geography is obviously total US. Channel/type of store: xAOC Incl Conv is the biggest market combination that Nielsen tracks. This combines grocery channel, drug channel, mass merchandisers, Walmart, club stores (minus Costco), dollar stores (minus a couple that don’t report), convenience stores, and military (DECA stores only). Basically every single store that reports to Nielsen will be included. So this is as close to total national sales as you can get from Nielsen.

Retailer Marketing Area: RMA really just refers to the physical geography of a market. This is the set of counties that a retailer believes it serves based on its physical store locations. Sales for the RMA are estimated by including all the stores in those counties. You can get an RMA sales estimate for different channels though – you could get an xAOC estimate within an RMA or you could get Grocery sales estimate within an RMA or a Drug estimate within an RMA. But all stores to be included in the RMA estimate have to fall within the RMA geography.

Corporation Reported (CORP): In my experience, a market that is labelled CORP just means it’s all the individual banners owned by the corporate entity. So Ahold Corp, for example, is a combination of the Stop & Shop banner and the two Giant banners owned by Ahold. I would think of CORP as a combination of individual RMA’s. Again, you could be looking at xAOC or some other individual channel in terms of which stores are included.

Definitely not true that these “types” that you have defined are additive, for base sales are any other measure.

Hope this helps!

Hello,

If I’m pulling Nielsen #s for a geography: ie California xAOC, would this capture IRI and other accounts without Nielsen contracts through a statistical projection? Are these accounted for at all?

Nielsen collects data from almost all the retailers in the channels they cover, but…there are some retailers that they cannot release to the manufacturers individually. An example of this is Kroger. If you pull California xAOC in Nielsen, Kroger-owned banners (like Ralph’s) are included in those numbers even though you cannot see Ralph’s by itself. As far as I know retailers that are not included or projected for in Nielsen are Costco and I think one of the Dollar banners (sorry, I forget which one is not in there). That may or may not be important, depending on the importance of those to your brand and category.

HI, Can you help me understand what are impulse channels??

I have not heard that term used in the US but I think it may be the same as what we call Convenience Stores. The bulk of their sales come from products that are often purchased on impulse, or not planned. These include things like salty snacks, candy, soft drinks, beer, cigarettes. Convenience stores (also called “C-stores”) are often found attached to gas stations in the US but can also be standalone locations. Hope that helps!

Can you tell me where Goetze Carame Cremes falls on the retail channel IRI data ? Wondering what number it is on the list of items in stores.

Karen,

For any data specifics, you should contact Nielsen and/or IRI. As independent consultants, Robin and I only have access to data that has been purchased and share with us by our manufacturer clients.

Where do forecourt retailers fit into Nielsen’s categorisation?

Do they come under convenience or another category?

It looks like you may be in the UK, as we really don’t use the term “forecourt retailers” much in the US. Based on what I saw when I looked it up, I’m pretty sure it’s part of the Convenience Store channel. I’ve seen reports here that have “C-Store/Gas,” so that is also informing my answer.

I’m looking into a specific Nielsen report. Can you please help me out whit this very basic question on how to read the data.

What is ‘Buyer index’ as opposed to ‘Buyer distribution’ and ‘panel distribution’?

Br, Rikke

The measures you are asking about are on a demographics report with panel data (as opposed to POS data). Buyer distribution is what % of the brand (or product) buyers are in that demo group and panel distribution is what % of the general population are in that demo group. The Buyer Index = buyer distribution / panel distribution. If the index is over 100 then that demo group overindexes for the product. For example, if Buyer Index = 150 for your brand for HH with Kids, then they make up 50% more buyers for your brand than they do in the population so the brand is especially strong among those HHs. An index of 120 or above is usually considered high, while 80 or below is low. Hope that helps!

Does Nielsen cover DIY channel?

Unfortunately DIY channel is not included in Nielsen’s Total US definition for POS/scanner data. See the section on Home Improvement channel on this post: . Another source for that channel is Kantar, as somebody commented in that post.

Does NC next to a market example (Vermont xAOC-NC) denote (No Convenience)?

Thanks

According to someone at Nielsen, “NC” at the end of a market description means “No Causal,” as in no causal facts are available for that geography. Sales, distribution and average price information is available but nothing that involves merchandising. Hope that helps!

Does MULO Data include liquor chains?

Unfortunately, no, it does not include Liquor stores.

What type of retailers would be included under Mass x Walmart? Thanks

Biggest one is Target. Kmart is also included, plus a few other more regional mass merchandisers.

Hope everyone is staying safe!!!! I just wanted to check in here on how current this information is. It is GREAT, so don’t get me wrong!! I keep the link on my bookmarks bar for my reference and to send to others. My question is surrounding Whole Foods being included in Nielsen Food (and thus, xAOC). I’ve received conflicting responses around this, so let me ask the experts… As of today, is WFM included in NIELSEN Total US Food??? And to a lesser extent, I guess I should ask concerning Trader Joes’s and HEB as well? I think I know the answer to my second question, but never hurts to have a refresher!!!!

Yes, Whole Foods Market is considered a Food account and therefore is included in Total US Food.

HEB provides census data and is included in Total US Food but is not available as an individual retailer.

Trader Joe’s and Aldi do not provide any data to IRI or Nielsen.

But Trader Joe’s and Aldi are projected for in Total US – MULO, at least for IRI. My understanding is, the only retailers who aren’t projected for at all are Costco and 99 cents

Is Kroger data incorporated into Nielsen US Food data or it strictly visible to IRI?

KC Reddy

Senior Sales Analyst

C Mondavi & Family

Nielsen receives and incorporates Kroger data into xAOC and other high level geographies like census region, statelines, etc. What Nielsen cannot do is report data at the trading area level for Kroger corporate or any of its banners. The ability to provide visibility into Kroger specifically is exclusive to IRI.

Are Save A Lot stores (headquartered in Missouri) included in Total US xAOC numbers?

From what I can tell, yes. I happened to pull some Nielsen data yesterday (8/11/10) and “Save-A-Lot Core TA” is available, so I’m sure it’s also part of the Total US xAOC aggregate. You should confirm with your Nielsen rep, though, in case there is some nuance as to what stores are included in the “Core” designation.

Note 1 above says data for Whole Foods is not included in the Grocery Channel for MULO. Is this still valid, and is the table overall still valid?

Whole Foods Market is now included in the Grocery channel for both Nielsen and IRI. Nielsen received exclusive data from Whole Foods and uses that in xAOC as well as releasing retailer level data for WFM. IRI doesn’t have data from Whole Foods but they do project their MULO totals to cover what they estimate is the Whole Foods volume.

Thanks for calling this to our attention – we will take a look to see if anything else needs to be updated in this post. There is another more recent post that covers markets and might have information of interest to you:

https://www.cpgdatainsights.com/understand-your-database/markets-part-2-the-nitty-gritty/