One of the key steps in an IRI/Nielsen pricing analysis is drilling down to look at regular price vs. sale price. Syndicated databases are chock full of price measures and, even for regular price, you still have a choice to make. There are two proxies for regular price: Non-Promoted Price and Base Price. In this post, I’ll attempt to convince you that you should (almost) never use Non-Promoted Price.

One of the key steps in an IRI/Nielsen pricing analysis is drilling down to look at regular price vs. sale price. Syndicated databases are chock full of price measures and, even for regular price, you still have a choice to make. There are two proxies for regular price: Non-Promoted Price and Base Price. In this post, I’ll attempt to convince you that you should (almost) never use Non-Promoted Price.

If trade promotion isn’t present for your product or you’re analyzing a retailer with an everyday low price (EDLP) strategy, you don’t really need to worry about any of this. There won’t be a difference between regular price and sales price. You can just stick with average price.

Syndicated databases are chock full of price measures and, even for regular price, you still have a choice to make. There are two proxies for regular price: Non-Promoted Price and Base Price. In this post, I’ll attempt to convince you that you should almost never use Non-Promoted Price.

First, let me say that I understand why you want to use Non-Promoted Price. It seems clearer, more intuitive. It’s simply an average of prices paid in stores without promotion during that reporting period. Why wouldn’t that be a great measure of regular price?

And Base Price? That’s an estimated value, generated by IRI/Nielsen methodology. And you may ask yourself “If they are estimating that price, how do I know that it’s right? Plus it’s harder to explain. So why should I use it when I can use this perfectly straightforward Non-Promoted Price instead?”

Here’s why Base Price is almost always the better choice: it incorporates data from all stores, not just the stores that are promoting. IRI/Nielsen will have a Base Price estimate, based on the past, even for stores which are running a promotion. By contrast, and by definition, Non-Promoted Price only includes the stores that aren’t promoting. So Non-Promoted price will only be coming from a subset of stores. If regular price varies across stores, then regular price from the stores that aren’t promoting won’t necessarily be a good estimate of regular price in the stores that are promoting

You can see how this works in the example below.

A quick note on measure names: Non-Promoted Price may be called No Promo Price or No Merch Price in your pick list of facts.

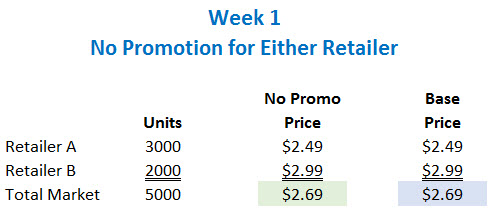

We have a hypothetical market made up of two retailers. In Week 1, there is no promotion at either retailer. Retailer B has a higher regular price than Retailer A. The Non-Promoted Price and the Base Price for the market are the same: $2.69.

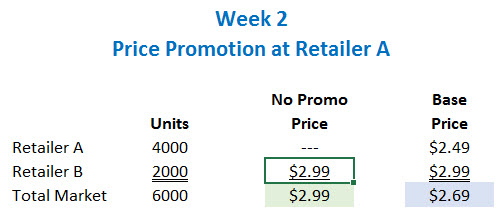

In Week 2, Retailer A runs a promotion in every store. There are no non-promoted price observations for Retailer A. Therefore, the Non-Promoted Price for the market comes only from Retailer B. It looks like the market’s Non-Promoted Price has increased from Week 1 ($2.69) to Week 2 ($2.99). But regular price hasn’t changed. Base Price, however, is stable across the two weeks because IRI/Nielsen incorporate past weeks’ non-promoted price observations for Retailer A into their Base Price calculation.

If you are looking at data for an individual retailer, there probably isn’t huge difference between Non-Promoted Price and Base Price because most retailers have consistent promotional timing across stores. But even at the account level, you can see how Non-Promoted Price could mislead. Base Price is the better default choice.

My one exception to the “never use Non-Promoted Price” rule? When you change your regular price. Regular price changes are incorporated quickly into your Non-Promoted Price measure, while it takes a few weeks for Base Price to reflect the change. In this scenario, you can use Non-Promoted Price to see if/when your new price is reflected at retail.

Did I convince you? Or do you still swear by Non-Promoted price? Had problems with Base Price? Leave a comment below to share your experiences.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles twice a month. We will not share your email address with anyone.

Thanks, this is quite insightful. Can you help me understand if base price is not present, would average price be better than non promo price to set pricing strategies? I would traditionally prefer to use non promo in such cases.

If base price is not available, which is often the case in countries outside the US/Canada, then non-promoted price is a better proxy than average price. If you examining data for a single retailer, then non-promoted price should work well. If you are combining across retailers, be aware that some retailers will have more non-promoted weeks than others and that can influence the average non-promoted price. But even with higher levels of market aggregation, non-promoted price would still be preferred over average price when looking at everyday pricing strategy.

quite insightful. I wonder in which cases, except when we have new price, we should look into non promoted price?

Sometimes non-promoted price is the only measure available, like when a company chooses to save some money and not get base sales in their database. (If you don’t get base sales, then base price is not available either.) Years ago non-promoted price was the only one available, plus it can be confusing to explain base pricing to some buyers. At the retailer/banner level, base price and non-promoted price are usually very close, if not identical.

Hi, I am still trying to understand how IRI/Nielsen calculate the base price. In the example, I understand how base price has been calculated in week 1, but up to week 2, how come the base price didn’t change at all if it is calculated based on past two weeks’ history? Thanks!

A price change is considered temporary for 6 weeks. After that, it will be considered to be the new base price.

In an instance where you are using a compilation of data to generally see what everyday vs promoted pricing is to come up with a pricing strategy (for comparison vs competition, to guide a pricing decision or item launch), wouldn’t using the lower base price $2.69 be mis-leading? It suggests an item should be priced everyday at a lower value, when the non-promo price clearly shows an everyday price would be $2.99 in your example.

Also, is base price also referred to as average price?

In my example, the base price of $2.69 is lower than the non-promoted prices of $2.99 because only one retailer is not promoting. So the non-promoted price doesn’t reflect the market average – some stores are missing from the calculation. That’s why the base price is a better choice if you want to assess the market average. If you are looking at an individual retailer, there usually isn’t much difference between base and non-promoted price.

Base price is not average price. Average price reflects all sales, whether they are promoted or non-promoted. Base price is estimating everyday price and therefore would typically be higher than average price.