Markets are one of the four dimensions that are fundamental to CPG data. I’ve written a two-part series to cover all aspects of the topic.

Who should read this post (Part 2)? Anyone interested in the details about how Nielsen/IRI/SPINS cover the following brick & mortar channels:

- Grocery/Food

- Mass Merchandise/Walmart

- Drug

- Dollar

- Club

- Military

- Convenience

- Pet

- Liquor

- Specialty Grocery

- Natural/Organic Supermarkets

Is your channel not listed here? Wondering about e-commerce (not bricks & mortar)? Read Part 1 of this series to find out whether IRI/Nielsen/SPINS cover your market of interest and, if not, who might.

The markets/channels covered in detail in this post are the foundational offerings from the CPG syndicated data vendors. These markets are POS-based, very robust, with a lot of detail available. I’ll discuss:

- How is each channel defined and does that differ by data vendor?

- What major retailers do and don’t cooperate?

- Whether an aggregate channel total is available or only account level markets for individual retailers?

Grocery

- Nielsen calls the Grocery channel “Total Food”. The Nielsen “Total Food” channel is exactly the same as the IRI “Grocery” universe. Just remember that when Nielsen/IRI talk about Total Food, they are talking about a type of retailer, not a type of product.

- For both Nielsen/IRI, Grocery covers all retailers with sales above $2MM annually so the vast majority of channel volume is covered (at least about 90% for most products and close to 100% for many categories).

- A channel-level total is available as well as account-level data for nearly every major retailer. In addition, there are aggregates for census regions, states, and around 50 metro markets.

- Major non-cooperators are Aldi and Trader Joes so both Nielsen/IRI need to estimate sales for these guys to create a Food channel total.

- HEB allows their data to be used to create an accurate channel total but you can’t get data for HEB alone from either vendor.

- Whole Foods Market provides data to Nielsen only. IRI must estimate Whole Foods sales for their channel total and cannot provide retailer data for WFM.

- Kroger only allows retailer level data to be sold by IRI. Nielsen has Kroger data so can incorporate it into their Food channel total but cannot release Kroger details.

Mass Merchandise/Walmart

- Most major chains do cooperate, including Walmart. Both data vendors each offer the same accounts.

- There is no channel total available from either data vendor, only individual retail accounts.

- It is my understanding that Walmart does not allow IRI to release their private label data so please do inquire about that if you are buying Walmart data and their store brands are significant in your category. Depending on how your contract is structured, there is often a fairly large additional charge to get Walmart data (even though Walmart is one of the largest customers for almost all manufacturers).

Drug

- Both Nielsen/IRI cover all stores with sales above $1MM annually.

- A Drug channel total is available as well as census regions and metro markets.

- There are not that many individual retail accounts offered because the channel is dominated by a few big players.

- Although there are no big non-cooperators, CVS does not release private label sales data to either vendor so that is a pretty big gap.

Dollar

- Dollar General, Family Dollar, and Fred’s are offered as retailer accounts by both vendors.

- Dollar Tree is not available from either vendor.

- No channel total (i.e. Total Dollar Stores) available from either vendor.

Club

- BJ’s & Sam’s Club are available from both Nielsen/IRI

- Sam’s Club does not allow UPC level release of private label sales but the brand and category totals will include Sam’s Club private label.

- There is no channel total available.

- Costco is not available from either vendor in a standard format. Costco data is available from IRI as an entirely separate service called CRX. CRX does include some category level comparisons but likely doesn’t provide a full view of the category with UPC level detail for all competitors.

Military

- Data is available for DeCa and most of the exchanges but not the Coast Guard exchange.

- There is no aggregate channel total.

- To my knowledge, accounts offered are the same across data vendors.

Convenience (aka “C-Store”)

- A national Total Convenience aggregate (a channel total) is available as well as many additional accounts. I believe the Convenience channel includes stores that are part of gas stations as well as standalone stores. Both vendors provide this information.

- However, this is the only channel where offerings from Nielsen & IRI may differ significantly, in terms of which stores are included in their samples and how the channel is defined and projected. Contact each vendor for the details on their offering.

Pet

- Nielsen offers two aggregate Pet channels as well as exclusive access to Petco and Pet Supplies Plus. Other Pet retailers are also offered but are not exclusive to Nielsen. Scroll down to the comments to see more info on Nielsen’s offerings – thanks to one of our readers for updating us!

- I do not know the specifics of IRI’s offerings in this channel. I believe they have Pet Sense and Pet Smart at a minimum. Nielsen seems to have the edge for the Pet channel but things change so always check with both suppliers.

Liquor

- No national channel total available but there are Total Liquor aggregates for several states and/or metro areas.

- Many individual retailers are available.

- Neither Robin nor I have worked with data from this channel so can’t provide more details. Contact the vendors for more info. If any of you readers know more about Liquor syndicated data, please comment below or write us with info we can add and share!

We don’t know as much about how the SPINS channels are defined. We asked SPINS and they declined to provide any details on which retailers are currently included in their markets. Here is what we know about the SPINS markets:

SPINS Natural/Organic Supermarkets:

- Full-format supermarket with more than $2 million in annual sales with at least 50% of sales from natural/organic products (as defined by SPINS) and less than 50% from supplements.

- This market from SPINS does not include Whole Foods. Instead, Whole Foods is included in the Food channel totals offered by Nielsen/IRI. You can see Whole Foods data separately in Nielsen only.

- The retailers included in this channel range from co-ops to associations to independent retailers to large regional chains.

- As mentioned above, SPINS won’t share specifics on which retailers they currently work with but Sprouts, Earth Fare, Mrs. Greens, and Fresh Tyme are examples of the type of retailers SPINS might cover.

SPINS Specialty Gourmet:

- These are also full-format supermarkets with more than $2 million in annual sales. At least 25% of their volume comes from SPINS-defined specialty items and these retailers have a strong focus on specialty, imported, natural, and organic items.

- Again, we were unable to extract any specifics from SPINS but in the past this channel has included chains like D’Agostino and Bristol Farms.

A few more general points about markets:

When I say above that no channel total is available or that a retailer does not cooperate, I’m talking about POS data. It’s possible that additional information can be obtained from the Nielsen/IRI household panel, which is based on a sample of 100,000 or so households where everything is self scanned at home and every retailer is reported. However, the panel data is much more expensive and much less robust than the POS data (e.g. not appropriate for weekly tracking, frequently will have inadequate sample sizes at the UPC level).

Both Nielsen and IRI provide a multi-channel aggregate which represents (as close as they can get) total U.S. FMCG sales. When you read articles in the press citing syndicated data, you’ll see these cryptic market names called MULO and xAOC. We have a post all about these multi-channel markets so I’m not going to go into details here.

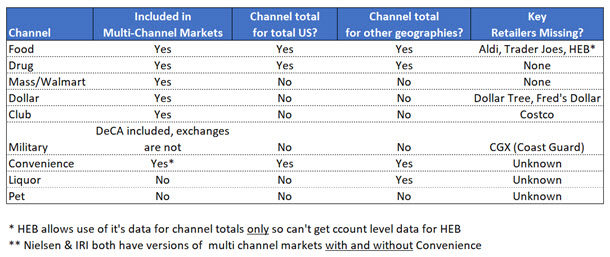

Here’s a summary of to help you keep track of some of the details discussed above:

In this post, I’ve tried to provide as much detail as possible and that means I’m going out on a limb in terms of accuracy (since things can change quickly in the world of syndicated data). The best way to know exactly what’s available is to contact the data vendors and ask them! Update: here’s an article from Kurt Jetta talking about some additional data exceptions/restrictions.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email inbox. We publish articles once a month (or even less frequently). We will not share your email address with anyone.

what does “Average Weekly Dollars per Store Selling” mean? what is the calculation involved? It is a standard metric in IRI and it comes in $ dollars, units, and volume version with the average weekly dollars/units/volume per store selling. How do you use it and interpret it? can it be used at the UPC item level? Is it relevant or useful at the 52weeks time period or at the total U.S. market level? Is it a way to compare retailers, brands, or UPC/item efficiency or so my guess at premiumization?

there is no glossary term for this metric. IRI does publish a definitions guide and it seemed to be represented in it, but I could not figure out a practical understanding for it. I am just looking for some help on what this is and how it might be useful

Avg Weekly Sales per Store selling is a type of velocity measure that tells you how well a product sells, in the places where it is available. It’s a way to compare product performance for things that have very different distribution. It can be used at any level of product, geography and time. Read this post to learn more about velocity. You’ll notice that sales per store selling is not mentioned because although it is a velocity measure, it cannot be used to compare across different retailers.

A retailer will use this measure when making decisions about which items to carry and delist from the shelf and also where to place items within the plan-o-gram. It is often an input needed by space management software.

[Thanks for the question. In the future, please use the Contact Us button when asking a question not related to a specific post, do not ask as a commment to an unrelated post.]

Does Kroger Private Label data populate on MULA?

If you are not seeing any Private Label data for Kroger it may be that Kroger does not release PL data for that particular category. It’s also possible that you cannot look at PL for Kroger specifically but it is included when looking at channel totals like Total US MULO or Total US Food. Check with your IRI client service rep to confirm (and let us know what you find out!).

Is the list of data and providers current?

It’s current, to the best of my knowledge, as of June 2020.

Hi! Great info; you two are clearly at the top of the pyramid in this field!

I’m interested in finding ways to help our customers get POS data covering their own SKUs directly from the retailers. Have you written anything about how to navigate that environment (e.g.; some are made available at no cost through portals, some are sold through subscriptions and some are only available through syndicators). Our customers can get great value from daily or even weekly store/SKU level data but many don’t have access (either knowledge or budget) in the way.

Any guidance you can give here would be great!

Thanks!

Mat

Thanks for the kind words – glad you’re finding the CPG Data Tip Sheet helpful! The short answer to your question is No, we do not have a post with all that detail. It would be a great resource to put together, although the availability of POS data from retailers and the associated costs are very dynamic. This post addresses the topic and compares syndicated data to retailer direct data and when each useful. My opinion is that retailer direct data is most useful for logistics and supply chain use cases, less so for marketing and sales. The exception is if a manufacturer has no access to syndicated data (POS or panel), in which case retailer direct data is better than not having any consumption data.

In regards to Total Food Drug Liquor; what all is included in the Food data? Is it just grocery, or does it include Mass/Walmart, Club, etc.?

“Food” in Nielsen/IRI means grocery retailers. “Food” would not include Walmart, other mass merchandisers (e.g.Target) or club stores. Nielsen/IRI do cover those other channels but would not include them in “Food”.

Hi, I’d like to add that Nielsen does offer two pet channels now. One is a “Neighborhood Pet Channel” including Pet Supplies Plus, and other independents.

The other channel is a “Total US Pet” which adds in Petco + Petsmart. At this time 80% of stores in this channel are “census” meaning Nielsen has data directly from those stores, and projects for the remaining amount.

Nielsen has exclusive access to Petco and Pet Supplies Plus retailer data at this time.

Thanks for the info, Grant. The post will be/has been updated.

Great information in the article! Here’s some more information on SPINS to supplement your post. I work closely with this data as a Senior Category Manager in Produce and previous experience in meat perishables as a buyer.

SPINS Channels Available:

Natural, Regional Independent Grocery, Convenience, Ecomm, Drug, Mass, Club, MULO, Dollar, Military and Pet.

SPINS Natural Channel includes 60+ retailers with account level data such as Sprouts and Bristol Farms. Exclusive to SPINS. I’m not able to publish the full list given legal considerations.

SPINS mirrors the data available in Nielsen/ IRI plus adds additional coverage for natural retailers exclusive to their service.

I have some information on liquor channel since I spent 3 years as a Category Manager for a top alcohol company. I’ll save that for another day.

Thanks for sharing!

Quick Question:

Winco Foods data is included in Nielsen, correct?

Thanks as always for your assistance

As far as I know Winco is included in Nielsen but I’m not sure if you can see it individually. So in the Northwest, California, Texas market-level geographies Winco is included.

Hi Sally, Robin,

Thank you. This is so helpful. One question I have is whether Nielsen or IRI also give store wise sales of these accounts ?

For example: I have seen IRI giving store wise share for Kroger. But I dont see other measures. Similarly does Nielsne give store wise measures for any accounts ?

Thank you for your information.

I’m not sure what you mean by “store wise”? Do you mean information at the store level, rather than for the account as a whole? If so, I believe some retailers do allow Nielsen and IRI (aka Circana) to distribute store level reports/data with retailer permission but it wouldn’t be every retailer and it would be on a case by case basis. If I’m not understanding your question, please let me know. It would be more common to get store level data from the retailer directly.

Hi Sally,

Thanks for the reply. Yes, I meant Store level data. The reason why Store level data is helpful from IRI or Nielsen is we get to see the market share at store level directly from IRI or Nielsen. I find it tough to calculate market share in a particular store from retailer sales data.

Is this common practice in industry or a store wise share is calculated from Retailer sales data ?

Thanks again.

No, you are right that it’s not typical to get the full category the retailer sales data. They typically provide only your own items. Though I think some will provide at least a category total? So in that case you might be able to calculate a share number even if you cannot look at details regarding what competitors are doing. But it would be retailer by retailer question and policy. So you might need to ask Nielsen/IRI about what you can get from them in regards to store level data (it’s typically on a report basis with the permission of the retailer, in my experience. And I’ve had retailers say “no” when a client has made a request for store level data!). And also find out if there is any category data in any of the retailer provided data (just a category total for the store would do since you are looking to calculate share, not look at competitor detail).