The “syndicatedness” of IRI/Nielsen data is one thing that makes it so powerful. Think about it: IRI and Nielsen capture, label and organize millions of product transactions across hundreds of retailers and then distribute a comprehensive dataset set to thousands of businesses. As a result, everyone can start with the same data, making it easier to agree on conclusions and to talk the same language. But even I have to admit that syndicated data can be, well, a little generic.

The “syndicatedness” of IRI/Nielsen data is one thing that makes it so powerful. Think about it: IRI and Nielsen capture, label and organize millions of product transactions across hundreds of retailers and then distribute a comprehensive dataset set to thousands of businesses. As a result, everyone can start with the same data, making it easier to agree on conclusions and to talk the same language. But even I have to admit that syndicated data can be, well, a little generic.

You can contract with Nielsen/IRI for custom versions of their databases. But many companies, especially those with smaller budgets, have to customize in house.

You can customize on any of the four dimensions that underlie every CPG database. Grouping markets or periods is common and relatively straightforward. In my experience, it’s the product dimension (which covers category definitions, product descriptions and brand names) where the most complicated, and urgently needed, modification takes place. In this two-part blog post series, I’ll show you the following three ways to customize your product data and better reflect your organization’s view of the business:

- Rename Product Values

- Group Product Values

- Create New Attributes

In this blog post, I’ll cover points one and two. I’ll save the third for my next post.

Before I begin, a note on terminology: Your product data is built from attributes and characteristics. If you want to learn more about this crucial concept, read this post before proceeding. I believe IRI calls these factors attributes and Nielsen calls them characteristics. In this post, I’ll use the term attributes because it comes first, alphabetically. (As always, CPG Data Tip Sheet is determinedly vendor agnostic.)

1. Rename Product Values

This is the simplest type of customization. You can apply it to product descriptions, brand names, retailer names and just about everything else in your database! You might choose to change these values for several reasons:

- They’re not the terms your organization uses.

- They’re unattractive, difficult to read or too long.

- They’re (very rarely) wrong.

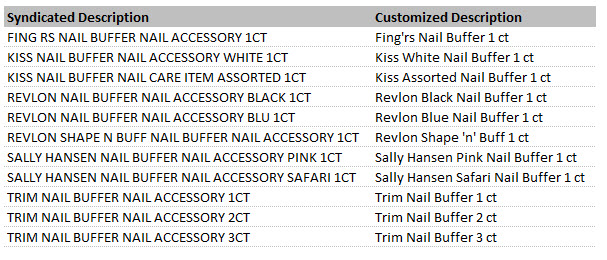

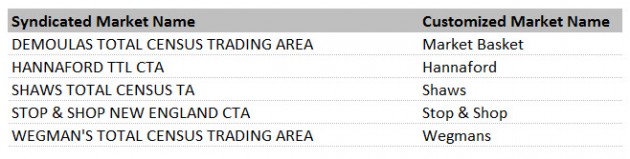

Here are two examples, one with product descriptions and one with market (retailer) names:

The key to this type of customization is to avoid manually changing these labels every time you do an analysis. Instead, make one translation table for each attribute and keep it updated. If you are using Excel, you can then use VLOOKUP to add the consistent, correct values to each analysis via a formula. (For more information on how to do this, see my post on VLOOKUP.) Other business analysis tools will allow you to do something similar.

2. Group Product Values

Sometimes, Nielsen/IRI will give you more values for an attribute than you need or want. For example, yesterday I saw a database with nearly 100 different values in the FLAVOR attribute, including: Cinnamon, Cinnamon Vanilla, Pumpkin Spice, Apple Cinnamon, Cinnamon Apple and Cinnamon Swirl. Nielsen/IRI code exactly what’s on the package, no more, no less. And different manufacturers use different names for what is essentially the same thing from a consumer perspective (Apple Cinnamon vs. Cinnamon Apple). While it’s good to have all this detail when needed, it can get in the way when conducting an analysis or presenting your findings.

And even if attribute values are truly different (Apple Cinnamon vs. Pumpkin Spice), you might see a bigger pattern emerge by grouping them in more meaningful ways not coded by Nielsen or IRI. For example, you would likely benefit from looking at sales trends among products that are Cinnamon-y. Or, at a higher level, Sweet vs. Savory or Plain vs. Flavored.

So why don’t Nielsen and IRI include these higher level attributes? They can, if you have the budget to pay for a custom database. But, for underlying syndicated data, they avoid attributes that require judgment. It’s too hard to be consistent, they’re too difficult to maintain and someone will always disagree with them. Other attributes that are good candidates for grouping:

- Brand: Group smaller brands into “All Other Brands.” This is very common, and we’ve shown examples in other posts.

- Package: Consolidate and rename package types. Nielsen/IRI err on the side of more distinctions, not less. Often these small differences are not relevant for a particular category.

- Size: Slightly different sizes are often priced and promoted together. You need to group them together for meaningful analysis.

Before you get going with your grouping, here are a few things to keep in mind:

- Decide whether to create the groups in the vendor software (e.g. Nielsen Answers or IRI Market Advantage). This requires some thought. It can be tedious to set up groups in the software and even more tedious to maintain. If the grouping logic is simple (e.g. you want to group three segments together, you want all products in the segment, and those segments won’t change) it’s often worth it to set up in the vendor software, especially if it’s something you’ll need more than once.

- Create lookup tables. As with renaming, efficient and consistent grouping depends on it. For a few examples, check out this spreadsheet of attribute lookup tables.

- Watch for new values. When a product comes on the market with the new flavor Apple Cinnamon Twist, you’ll need to add that flavor to your grouping scheme, regardless of how you are maintaining the groups (in the vendor software or outside of it).

- Document your grouping criteria. Super important! This will make it easier to add values later, especially if you pass the task to someone else.

So those are two relatively straightforward ways to customize your Nielsen/IRI syndicated data in house. The third approach is to create new attributes. Since this is a bit more complex and also has some pitfalls associated with it, I’ll discuss it in a future post. Stay tuned!

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles twice a month. We will not share your email address with anyone.

This post was originally published in 2014 and has been updated to reflect industry changes.

Nielsen/IRI are doing a great project to collect and analyse product data. This is very useful to retailers.