In my previous blog post, I described two ways to customize your Nielsen/IRI product data by renaming and grouping product values. In a continuation of that post, I’ll now describe a third way of customizing your data—by creating new attributes.

In my previous blog post, I described two ways to customize your Nielsen/IRI product data by renaming and grouping product values. In a continuation of that post, I’ll now describe a third way of customizing your data—by creating new attributes.

3. Create New Attributes

We’re all accustomed to creating new measures, like dividing dollars by units to create price. By the same token, you can sometimes enhance your analysis by creating new product attributes. Beware: this is an advanced technique that not everyone needs to do or should do.

Why create a new attribute?

Before launching into the how, let’s talk about the why. Why aren’t these attributes already available in Nielsen/IRI/SPINS data? There can be several reasons:

1) The attributes are, in fact, coded by Nielsen/IRI/SPINS, but you don’t have them in your data. Why? Access to certain types of attributes can cost more, and maybe your organization hasn’t covered the additional cost. Or maybe you didn’t ask for these attributes. When you buy a one-time Excel report or ask for data on a new category, you have to specify the attributes you want—and when you’re new to the data you don’t always know what to ask for. The moral of the story: Identify the factors important to you and then look for them in Nielsen/IRI/SPINS attributes before buying.

2) Nielsen/IRI/SPINS aren’t yet coding an emerging product characteristic. Think about the Greek yogurt segment. When the first Greek-style yogurt came out, do you think Nielsen/IRI/SPINS coded for it? I doubt it. At first, yogurt manufacturers who were attuned to this emerging trend probably had to create a custom grouping for those products. But I’m sure “Greek” is now captured somehow in the yogurt category attributes.

3) Your category has fewer sophisticated manufacturers buying (and therefore troubleshooting) the data. If few clients are asking for an attribute, and therefore there are not a lot of buyers to underwrite the costs of expanding or changing coding for the category, then Nielson/IRI/SPINS are less likely to undertake it.

4) The attribute is important in your category but it’s not something that is obvious from package text. An example of this would be something about the physical product that is (theoretically) evident to the buyer but might be subtle and not clearly reflected in the package text.

5) The attribute is specific to your company and the way you look at things. If this is the case, make sure the attribute is truly important from a consumer/retailer perspective.

How to create a new attribute

OK, let’s assume you have a good reason to customize your data by creating a new product attribute. What’s the best way to go about it?

The key to successfully creating and, more importantly, maintaining a custom attribute is to use information already in the database. While you can do this in many different ways, I’ll illustrate with two common approaches:

Approach #1: Combine two existing attributes by concatenating them. Concatenation is simply a fancy word for “mash together.” For example, combining package and size is often a helpful way to streamline analysis. When doing promotion and price analysis, you need to corral UPCs into product groups, and sometimes it takes a combination of attributes to do this. So combining individual attributes into one mash-up attribute makes the analysis easier.

Approach #2: Pull an attribute from the product description. I once worked on an analysis of nail implements (files, smoothers, clippers, etc.). This data was delivered as a one-time Excel report as part of a larger consulting project. Unfortunately, the Type attribute for a lot of the tools specific only the generic value “Accessory”. Luckily, the product description had more detail, and we used it to create a more descriptive custom Type attribute.

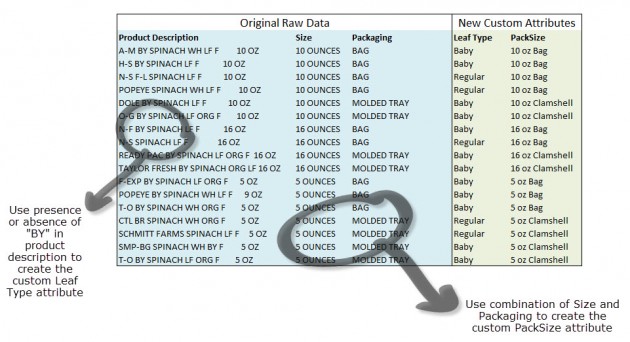

In the table below, I illustrate both above approaches in one example. In the Spinach category, there’s a big difference between baby spinach and regular spinach. They have different usage, shelf position and competitors. But my client’s database had no attribute for “Baby vs. Regular.” Luckily, “BBY” appears in the product description, so analysts (like me!) can use it to create a new attribute. In addition, spinach of the same size (ounces) can be priced differently depending on the packaging (bag versus clamshell). And the retailer organizes the planogram based on a combination of size and package type. So I need to combine package and size to create my product groups. In the table, you can see the description, the original attributes, and the two new attributes I’ve created.

A warning about using data outside your database

When you start creating new attributes, you may be tempted to create some based on information outside your syndicated database (such as from outside research or your own expert knowledge). Sometimes you really do need to do this. But be careful. Outside data is not only hard to maintain, it’s also difficult to ensure its accuracy and consistency going forward.

What’s an example of an alluring attribute that can lead to heartache down the road? Say you categorize brands into “Value,” “Mainstream,” and “Premium” based on a one-time survey of consumer perceptions you conducted. You decide to marry this to your Nielsen/IRI database and create a new “Brand Price Positioning” attribute. But what do you do when new brands enter the market? How will you keep these groupings up to date? You may have to guess where the new brands fit, mixing your data source. Odds are you’ll have to eventually abandon your new attribute because you can no longer maintain it.

When you’re tempted to use external information, try to find a database-linked alternative instead. Be creative. Look for something in the product description, in other attributes, or in the facts themselves that can transform your internal category knowledge into a rule that anyone can apply using database variables you can count on appearing for new products. If you can’t find anything, and are relying on outside information to create and maintain your attribute, proceed with caution! Think through how you will handle new items and document, document, document.

What problems are you encountering with your product attributes? What ingenious solutions have you uncovered? Comment below to share your experiences.

Did you find this article useful? Subscribe to CPG Data Tip Sheet to get future posts delivered to your email in-box. We publish articles twice a month. We will not share your email address with anyone.

This post was originally published in 2014 and has been updated to reflect industry changes.

Wanted to let you know that I just did this very thing! Category is frozen patties and I needed to get to price per patty and ounces per patty for different competitors. Price per package is not always comparable since there can be a different number of patties in a package (4, 6, 8, 12) and Price per Volume is not that meaningful to a consumer. Luckily the IRI database has attributes for total package size in ounces and count (# of patties per package). I calculated price per patty (intuitive pricing measure for this category) and also ounces per patty from those. The size of each patty was important since that can be different depending on the brand, meat type, pre-cooked vs. uncooked.

Great details and example of how dynamic planograms and category insights can be used to create better overall planograms, inventory management, and whole store floor planning. https://www.scorpionplanogram.com/category-insights/